On another thread @Mart asked can somebody provide a lesson on UK wholesale prices and how they work ?

He was wondering why the live price he was seeing on the https://grid.iamkate.com site was jumping around. He also believed the price is closely linked to the gas generation price.

I thought it was worth starting a new thread as its quite a broad question and I'm trying to keep it simple. I’ve tried to find an online idiots guide, but have so far failed to find one good enough.

So I thought I would write up something up but remember folks, I am ONLY talking about wholesale prices and NOT retail prices. I will probably cover that later.

----------------------------------------------

Why does the leccy price track the gas generation price.

(From the Financial Times)

Why do wholesale power prices track gas prices ?

Pricing in Britain’s wholesale electricity market, like on the continent, is based on “short-run marginal costs”. Every electricity generator puts a bid in but the daily market price is set at the level that ensures there will be sufficient supply to meet demand. In other words, the price is always set by the most expensive plant — usually a fossil fuel-fired one — required that day.

In practice, this means gas-fired power plants, which still account for just under 40 per cent of Britain’s electricity supply, set the power price more than 80 per cent of the time, according to academics at University College London.

(From Good Energy which maybe a bit easier to understand)

So, how is gas setting the price ?

Gas sets the price of electricity, because the electricity price in every half hour period is set by the marginal cost of the last generating unit to be turned off to meet demand – which is invariably a gas power plant with high marginal costs.

----------------------------------------------

Why does the live leccy price appear to regularly oscillate.

Thats because your looking at the half hour balancing price which oscillates up at down throughout the day either side of the Day Ahead price.

(from www.elexon.co.uk)

How are the System Sell Price and the System Buy Price calculated ?

For each half hour trading period or ‘Settlement Period’, the ‘cash-out prices’ or ‘energy imbalance prices’ (System Sell Price and System Buy Price) will be calculated based on the cost incurred by National Grid – the System Operator – to bring the system into balance (based on accepted Balancing Mechanism Bids and Offers). The System Buy Price (SBP) is applied to BSC Parties that have negative imbalances and the System Sell Price (SSP) to those that have positive imbalances.

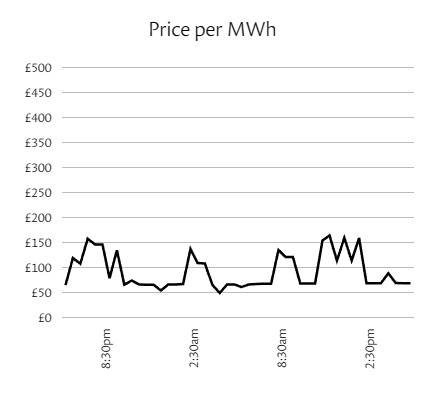

An example for today from the website @Mart was looking at,

https://grid.iamkate.com

You will notice from the above graph the price oscillates above and below the day ahead price from yesterday which was £101 / MWh.

If you really want a hard read, look here, I gave up to be honest.

https://bscdocs.elexon.co.uk/guidance-n ... g-guidance

----------------------------------------------

What types of energy prices are there.

I look at this website which gives a good commentary about the days movements in prices.

https://zenergi.co.uk/market-watch/

From yesterdays numbers,

What do these prices mean ?

As a market-traded commodity, leccy and gas doesn’t have just one price: buyers and sellers can enter into contracts hours, days, weeks, or months in advance.

Year Ahead Price – What the market thinks the worst case (good or bad) price of energy will be in a years time. In other words what generators are willing to take to offer power in a years time and what suppliers are willing to pay the generators in a years time. At this range there is little uncertainty about renewables as they generate an average (solar +/- 5% and wind +/- 10% on an annual basis). But there may be specific uncertainties, such as France’s nuke fleet is in trouble and we don't know how long its going to take to get fixed, Russia has cut off gas to Europe for the foreseeable future, China is buying up all the available LNG, etc. Used as a guide for agreeing annual PPA prices like the Ripple wind farms.

Day Ahead – Tomorrows price so mostly depends on the weather forecast, is it going to be windy, sunny, hot or cold. Also will depend upon gas availability, interconnector failures, Nuke breakdowns, or it could simply be the weekend or a bank holiday when there is generally less demand.

Front Month – This is the price for the block of the next calendar month, so today the Front Month will be for the month of July.

Front Quarter – This is for the block of the next calendar quarter so the next quarter will be for the block of July, Aug and Sep. But if todays date was 20th July the Front Quarter would be for the block of Oct, Nov, Dec (i.e, the quarter blocks are fixed on a calendar basis).

Now you might notice that the gas and leccy prices look numerically similar, in fact quite often they are the same. But the units are different because in the UK gas is priced in pence per therm and leccy is priced in pounds per MWh. I asked my energy trader friend why this was and he said its you crazy British people, I deal in Europe prices and both gas and leccy are all in Euros per MWh.

Note a therm of gas is approx 29.3 kWh (why do we do this to ourselves !).

https://en.wikipedia.org/wiki/Therm

So if we look at yesterdays Day Ahead prices of Gas and Leccy,

Day Ahead price of gas was 81p per therm, therefore 2.76p / kWh.

Day Ahead price of leccy was £101 per MWh or 10.1p / kWh.

So leccy today is 3.65 times the price of gas.

Gas plant efficiency is about 50% so that makes leccy 2x the price of gas. Then another 10% is lost in transmission so that makes leccy 2.2x the price of gas. But then you have to add on the capital cost of the gas plants, no idea what that is but it must make up some of the difference. Those efficiency numbers are an estimation but you get the idea.

Also note that the Front Month is a little higher than Day Ahead and Front Quarter is a bit higher than Front Month and Year Ahead is a lot higher, all because of increasing uncertainty the further into the future you go.

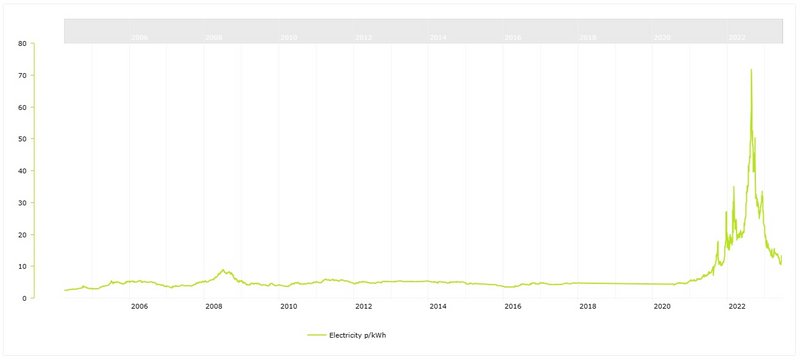

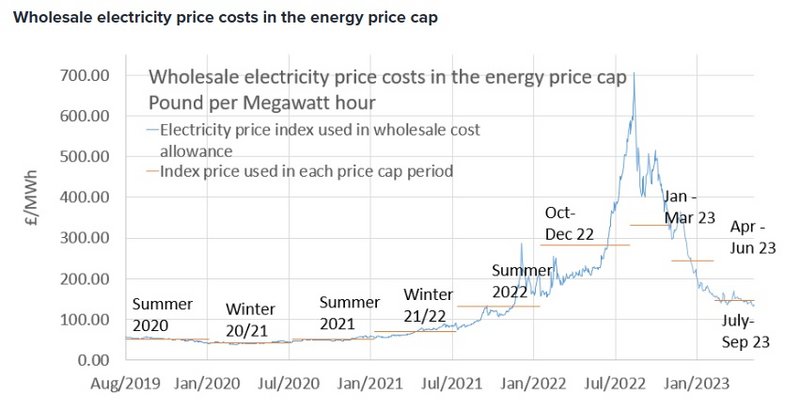

I'll do my next post regarding what the feck happened to energy prices over the past few years and why we went from almost consistent prices to crazy stuff. I know you can easily guess why, but I want to show the time line, plus why there have been big differences between Day Ahead vs Year Ahead and why this has really fecked us up based on how OFGEM regulation works.