Page 1 of 2

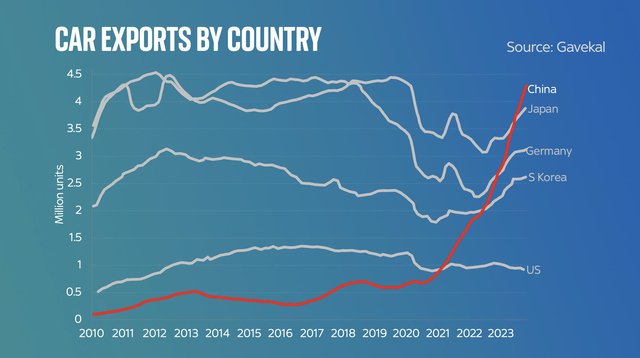

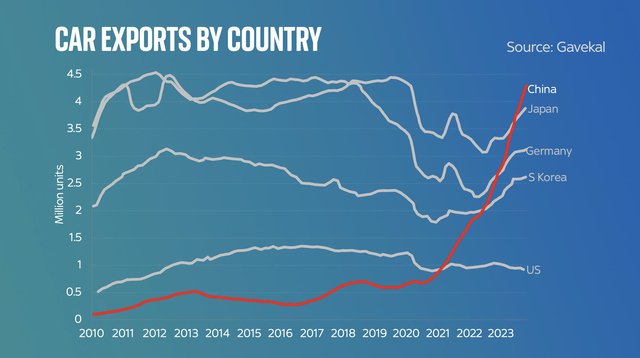

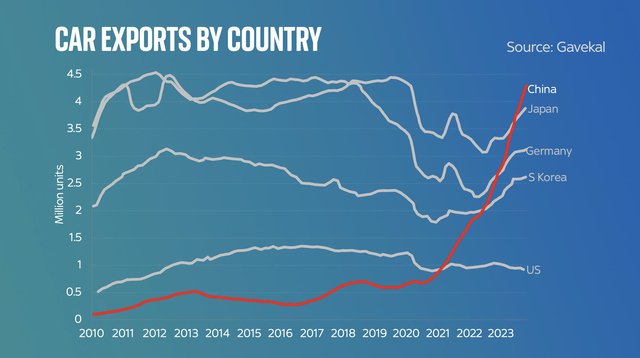

102.5% US Tarriffs on BEV's

Posted: Tue May 14, 2024 10:48 pm

by AlBargey

A bit crazy!

Might be related to this:

Sorry for the X link, but a good quick rundown with graphs:

https://x.com/EdConwaySky/status/1790433248348192996

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 9:57 am

by dan_b

Very much related I'd say.

I read yesterday that Ford is making an average loss of $100,000 per EV it makes which if true is insane. I know their sales of the F150 Lighting aren't exactly setting the world on fire, but are they really that far off making them at least break even? No wonder they keep going back to ICE-powered SUVs!

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 10:57 am

by Mart

dan_b wrote: ↑Wed May 15, 2024 9:57 am

Very much related I'd say.

I read yesterday that Ford is making an average loss of $100,000 per EV it makes which if true is insane. I know their sales of the F150 Lighting aren't exactly setting the world on fire, but are they really that far off making them at least break even? No wonder they keep going back to ICE-powered SUVs!

Yep, estimates of ~$100k loss, but respect for Ford who have split their company and report on Ford Model E (their electric division), so we get to see how it's doing. The other companies don't separate out EV's. Lucid have improved and gotten their per vehicle loss under $400k now. Stellantis claim some profits on BEV's, but me thinks they lie. Toyota have said their current platform (used for the BZ4X) isn't profitable, and words to the effect of 'can't be' as they plan to roll out a potentially profitable platform in 2026/27.

BYD may be profitable on BEV's, but as they sell roughly 50% BEV + 50% PHEV, it's hard to know.

So, does legacy auto, especially in the US up their game, or restrict cheaper imports? Normally I'm against protectionism, especially when it involves cleaner greener tech, like PV panels, but I can understand why the US is scared (terrified), just a shame they didn't take EV's seriously back in the early 2010's. Also it's a presidential election year, so protecting jobs from 'Johnny Foreigner' is always a vote winner on all sides, and Joe Biden is beholden to the UAW (United Auto Workers).

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 11:02 am

by Fintray

Mart wrote: ↑Wed May 15, 2024 10:57 am

Lucid have improved and gotten their per vehicle loss under

$400k now.

Is that the correct figure Mart???

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 11:26 am

by dan_b

According to the Wall Street Journal - a loss of $227k per vehicle

https://www.wsj.com/articles/lucid-elec ... s-51035f63

Although in that same article it says Ford loses $62k per vehicle, so who knows!

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 11:48 am

by Fintray

Wonder how long before they go belly up!

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 11:52 am

by dan_b

Lucid? Well they're now basically owned by the Saudi Government, and they have signed a deal to supply 100,000 cars to the Saudi Government, which included opening a final assembly plant in Saud, and the Saudis basically have unlimited money (until the oil runs out!), so I think Lucid is safe for the time being.

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 11:54 am

by Mart

Fintray wrote: ↑Wed May 15, 2024 11:02 am

Mart wrote: ↑Wed May 15, 2024 10:57 am

Lucid have improved and gotten their per vehicle loss under

$400k now.

Is that the correct figure Mart???

Scary isn't it?

As Dan says, some estimates are lower, but it's typically based on the cost of production in a quarter, divided by sales. Lucid is now producing less than they sell (I think) due to stockpiles, so that may help make the numbers looka tad better. Their losses have previously been consistently over $400k per vehicle. Weirdly, their CEO has been getting the highest salaries in the auto industry, $200m-$400m pa. [Obviously, Elon will get a lot more, if it's approved, but that was performance linked, with very tough targets, now achieved.]

Technically, Lucid are dead. They would have gone bust a year or two ago, but the Saudi PIF (Public Investment Fund) repeatedly inject a few $bn to keep them solvent, this dilutes the share value, and I think Saudi now owns 60%+. Lucid ($LCID) share price is now about $3 down from a past of around $25, and peaks of $55. [Edit - post crossed with Dan's.]

I did see a joke comment, but one that puts Ford's and Lucid's sales into context - if they stopped production, and for each 'sale' they simply bought a Tesla, then gave it away free instead, they would be losing less money.

Rivian's sales are growing well, but they still lose money on every vehicle, and their total negative balance, is now about twice that which Tesla reached, before the model 3 sales pushed up profits, and they went positive.

Not easy making and selling BEV's.

Re: 102.5% US Tarriffs on BEV's

Posted: Wed May 15, 2024 11:57 am

by Mart

dan_b wrote: ↑Wed May 15, 2024 11:52 am

Lucid? Well they're now basically owned by the Saudi Government, and they have signed a deal to supply 100,000 cars to the Saudi Government, which included opening a final assembly plant in Saud, and the Saudis basically have unlimited money (until the oil runs out!), so I think Lucid is safe for the time being.

Yep, their cash injections of several $bn, are equal to just a few days of oil revenue, as they earn about $1bn/day.

Re: 102.5% US Tarriffs on BEV's

Posted: Thu May 16, 2024 12:04 am

by AlBargey

dan_b wrote: ↑Wed May 15, 2024 9:57 am

Very much related I'd say.

I read yesterday that Ford is making an average loss of $100,000 per EV it makes which if true is insane. I know their sales of the F150 Lighting aren't exactly setting the world on fire, but are they really that far off making them at least break even? No wonder they keep going back to ICE-powered SUVs!

I'll have to try and find the source, but I'm not sure the legacy car makers losses are all they claim to be!

In effect the new technology in BEV vehicles require the same amount of R&D that went in to create the modern combustion engine, they haven't had to do this much in one go in 50+ years? But those legacy makers didn't just dump the costs of that creation onto the first years worth of sales, it was spread over 10-20 50? years.

Now we have a situation where R&D costs are taxed differently / incentivised so they want to max them out and claim BEV profitability is based on a one or two year window to claim the incentives/TAX write-down during which minimal sales are achieved, whereas the investment now should be drawn upon and paid off for many years just like the 50+ years worth of combustion engine R&D payback.

So a bit of a false claim to be losing £X when the investment is technically spread and to be used over many cars / years into the future.