AE-NMidlands wrote: ↑Sat Feb 08, 2025 1:01 pmHow do you hold this in an ISA?SporranMcDonald wrote: ↑Sat Feb 08, 2025 12:12 pm Thanks all, for flagging-up the Octopus Collective.

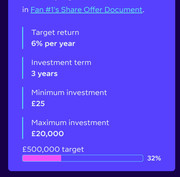

Before committing any £, I'll be looking at a possible alternative :-

Octopus Renewables Infrastructure Trust plc (ORIT) which invests in international renewable opportunities.

Thus, diversified, tradeable, ISA-able.

When I looked at a SIPP-type thing I found that the finance company's "management" fees would wipe out any tax gain saving I might make...

Thanks for this. I failed to include this in my (above) comparison. Definitely a significant factor.ORIT Key Information Document wrote: Portfolio transaction 0.50% costs = The impact of the costs of us buying and selling underlying investments for the product.

Other ongoing costs 1.15% = The impact of annual costs associated with the Company, including 0.95% management plus director remuneration, registrar fees, and audit fees.

I'm remembering that Investment Trusts tend to have (much) higher underlying costs that Unit Trusts, ETFs, etc. I think I was focused upon the final return.

Historic : I bought my ORIT holding within my shares ISA a/c. No special procedure.