Thanks Nowty, that was a shock to wake me up properly this morning. I'd thought (and by thought, I'd completely imagineered) that prices would normalise by 2027, giving Europe 5yrs to accelerate RE deployments, to negate the loss of the Russian gas, thereby bringing gas prices back down to their previous levels.

I suppose the good news is that higher prices for longer, will make it far more viable to roll out RE, and storage. Domestic prices for PV and batts are still high, but if that higher CAPEX can be offset against greater savings through this decade, then the numbers make more sense.

I do hope the prediction is off, but plan for the worst I suppose.

I'm being a bit pedantic now, so apologies, but the wording seems a bit strong, suggesting 'surging' demand for power for electric heating and transport over the next decade, I'd have thought the impact this decade wouldn't be that big. Growing, yes, but surging seems a tad optimistic, as even a move to 100% BEV car sales by 2030, won't have a massive net impact on leccy demand. I'd suggest the full electrification of road transport will be about +25% net, but will take till 2045(ish). However, heat pumps will be a bigger deal, and weighted towards just 6 months of the year, but again, not sure how large the impact will be this decade?

What this does scream at me, is the need to accelerate our RE rollout, both for environmental and economic reasons. Encouraging the demand side to rollout more PV would be a great move. Maybe re-introduce some form of the FiT again, even if minimal, say 3p to 5p/kWh, on the first 3,000kWh's and for just 10yrs, but it would still give the industry a well needed boost.

UK Wholesale Energy Market

Re: UK Wholesale Energy Market

8.7kWp PV [2.12kWp SSW + 4.61kWp ESE PV + 2.0kWp WNW PV]

Two BEV's.

Two small A2A heatpumps.

20kWh Battery storage.

Two BEV's.

Two small A2A heatpumps.

20kWh Battery storage.

Re: UK Wholesale Energy Market

Unfortunately that is a recipe to burn coal.

Re: UK Wholesale Energy Market

A direct example of this happened today in Belgium we saw swings of over 1GW in 15 minute periods with continuous 500EUR per MWh volatility all day. This is not how a grid likes to work and will result in blackouts when it goes wrong.

We saw the "impressive" arrangement that involves payments to wind power producers both for potentially being able to help balance the grid (fixed payment) and for actually doing so when needed (variable activation price).

With wind aFRR these farms now get paid a fixed amount to shut down at -100-200EUR negative prices.

So although wind power can't always guarantee it'll be able to reduce output due to the variability of wind, the grid operator still pays them a fixed amount for being a potential source of downward reserve...

Today local voltage and congestion management was all over the shop, we actually saw close to system split limits. International flows became dangerous in R-T and human coordination happened. We typically need to wait 15 min for phone reforceast... Eventually the regulator will notice and these costs will no longer be justified at their level. If you are concerned look at the 380 kV links.

We saw the "impressive" arrangement that involves payments to wind power producers both for potentially being able to help balance the grid (fixed payment) and for actually doing so when needed (variable activation price).

With wind aFRR these farms now get paid a fixed amount to shut down at -100-200EUR negative prices.

So although wind power can't always guarantee it'll be able to reduce output due to the variability of wind, the grid operator still pays them a fixed amount for being a potential source of downward reserve...

Today local voltage and congestion management was all over the shop, we actually saw close to system split limits. International flows became dangerous in R-T and human coordination happened. We typically need to wait 15 min for phone reforceast... Eventually the regulator will notice and these costs will no longer be justified at their level. If you are concerned look at the 380 kV links.

Re: UK Wholesale Energy Market

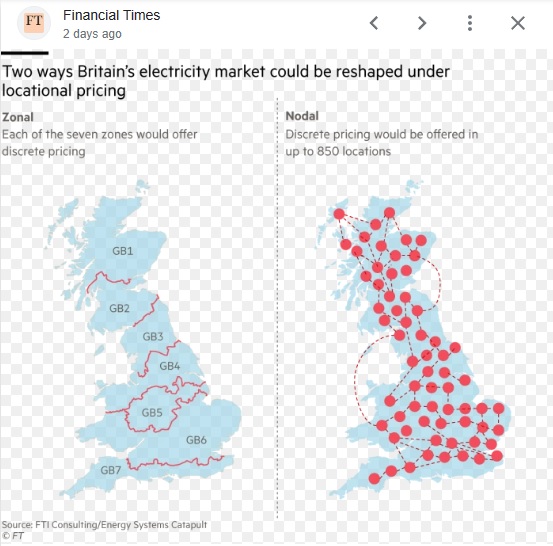

There is an article in the FT about Leccy locational pricing (possible wholesale leccy market reforms) which I briefly mentioned in message 18 of this thread, https://camelot-forum.co.uk/phpBB3/view ... =10#p34123

Paywall removed version of the FT article,

https://archive.ph/vMFhL

"Under FTI’s most extreme pricing scenario the annual average wholesale cost of electricity would range from £37.00 per megawatt/hour up to £58.70 per MWh by 2040."

i.e. The cheap leccy being in North Scotland and expensive leccy in the far South of England.

Paywall removed version of the FT article,

https://archive.ph/vMFhL

"Under FTI’s most extreme pricing scenario the annual average wholesale cost of electricity would range from £37.00 per megawatt/hour up to £58.70 per MWh by 2040."

i.e. The cheap leccy being in North Scotland and expensive leccy in the far South of England.

19.6kW PV > 117MWh generated

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3

Re: UK Wholesale Energy Market

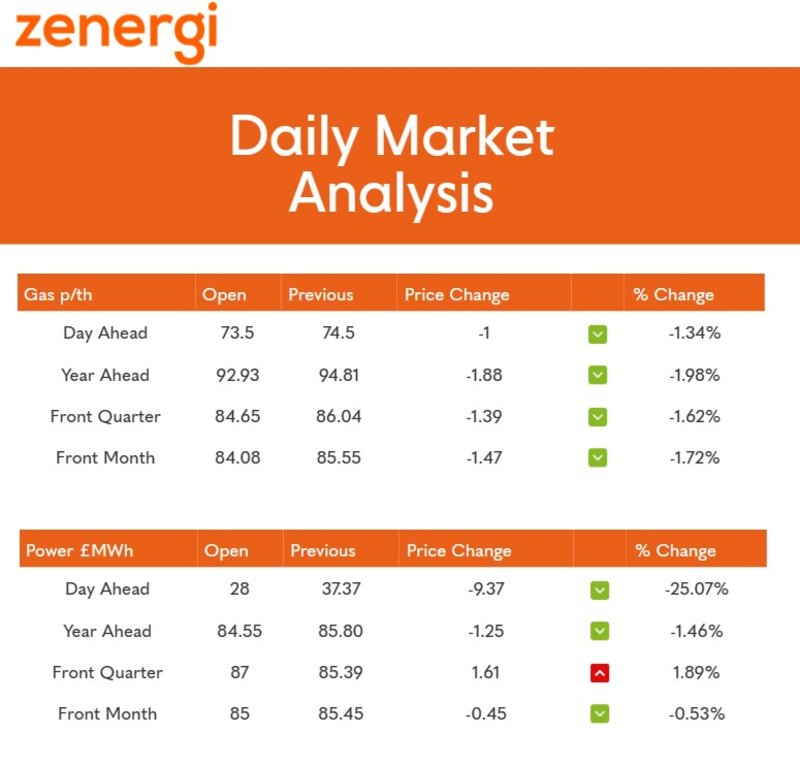

Wow, next day price of leccy has fallen to 2.8p / kWh, and gas is around 2.5p / kWh.

All this wind, lower Xmas demand and LNG ships queuing to get in.

https://zenergi.co.uk/market-watch/

All this wind, lower Xmas demand and LNG ships queuing to get in.

https://zenergi.co.uk/market-watch/

19.6kW PV > 117MWh generated

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3

Re: UK Wholesale Energy Market

nowty wrote: ↑Tue Jul 11, 2023 10:56 pm There is an article in the FT about Leccy locational pricing (possible wholesale leccy market reforms) which I briefly mentioned in message 18 of this thread, https://camelot-forum.co.uk/phpBB3/view ... =10#p34123

Paywall removed version of the FT article,

https://archive.ph/vMFhL

"Under FTI’s most extreme pricing scenario the annual average wholesale cost of electricity would range from £37.00 per megawatt/hour up to £58.70 per MWh by 2040."

i.e. The cheap leccy being in North Scotland and expensive leccy in the far South of England.

Might be something announced on leccy locational pricing tomorrow 12th March 2024, looks like Zonal is the most likely.

https://www.energylivenews.com/2024/03/ ... et-reform/

"Energy Secretary Claire Coutinho is set to reveal plans to revamp electricity markets, potentially saving households up to £45 annually and unlocking £35 billion in savings over 20 years. Under the proposed changes, locational pricing will be introduced to ensure a fairer distribution of renewable energy resources, reducing inefficiencies and lowering costs for consumers."

https://www.current-news.co.uk/desnz-to ... -redesign/

"Energy secretary Claire Coutinho is tomorrow (12 March) expected to formally announce the introduction of a new zonal pricing mechanism in Britain."

19.6kW PV > 117MWh generated

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3

Re: UK Wholesale Energy Market

So the locational pricing info seems to have been drowned out by the louder replacement gas power station story. But its there as an option and is now subject to a second consultation. Nodal is no longer being evaluated so its Zonal if it goes ahead. Or it could be some other watered down changes like locationally priced CFD's, other transmission charge reforms or even constraining access rights of renewables to the grid. If it goes ahead it will take up to 5 years to implement.

With the recent normalisation of gas market prices I suspect it will be a watered down version near to the status quo.

Press Release.

https://www.gov.uk/government/news/ener ... rgy-supply

2nd Consultation.

https://www.gov.uk/government/consultat ... nsultation

The evidence we have collected suggests there is a clear case for continuing to assess

locational pricing, specifically in the form of zonal pricing, due to the potential system

operation and consumer savings it could offer.

We have therefore decided to continue to consider locational pricing as an option to

deliver more efficient locational signals. However, we believe the risks to investor

confidence and deliverability of our 2035 decarbonisation targets are too great under nodal

pricing. We have therefore decided to discount nodal pricing.

With the recent normalisation of gas market prices I suspect it will be a watered down version near to the status quo.

Press Release.

https://www.gov.uk/government/news/ener ... rgy-supply

2nd Consultation.

https://www.gov.uk/government/consultat ... nsultation

The evidence we have collected suggests there is a clear case for continuing to assess

locational pricing, specifically in the form of zonal pricing, due to the potential system

operation and consumer savings it could offer.

We have therefore decided to continue to consider locational pricing as an option to

deliver more efficient locational signals. However, we believe the risks to investor

confidence and deliverability of our 2035 decarbonisation targets are too great under nodal

pricing. We have therefore decided to discount nodal pricing.

19.6kW PV > 117MWh generated

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3

Ripple 6.6kW Wind + 4.5kW PV > 34MWh generated

7 Other RE Coop's

105kWh EV storage

90kWh Home battery storage

40kWh Thermal storage

GSHP + A2A HP's

Rain water use > 530 m3