The table they show is a little bit exaggerated.spread-tee wrote: ↑Sat Mar 12, 2022 10:34 pm https://www.taxresearch.org.uk/Blog/202 ... increases/

Kerr-fuc*ing- ching

Incandescent with rage is how we should be feeling, but no-one seems to care and will vote the wankers back in next time

Desp

1) Distribution costs have gone up and will increasingly go up due to the upgrades requires to use more renewables.

2) The levies due to Supplier of last resort (SOLR) have actually gone up massively and don't even include the losses which are going to be incurred from the collapse of Bulb.

3) I doubt the production costs include the capital depreciation if being made by renewables. Think of the ripple wind farm, returns are actually quite low once you strip out the capital depreciation. There has been a 3 fold increase of return (in the first year) from WT1 compared with the original share offer but no where near a 40 fold increase in returns.

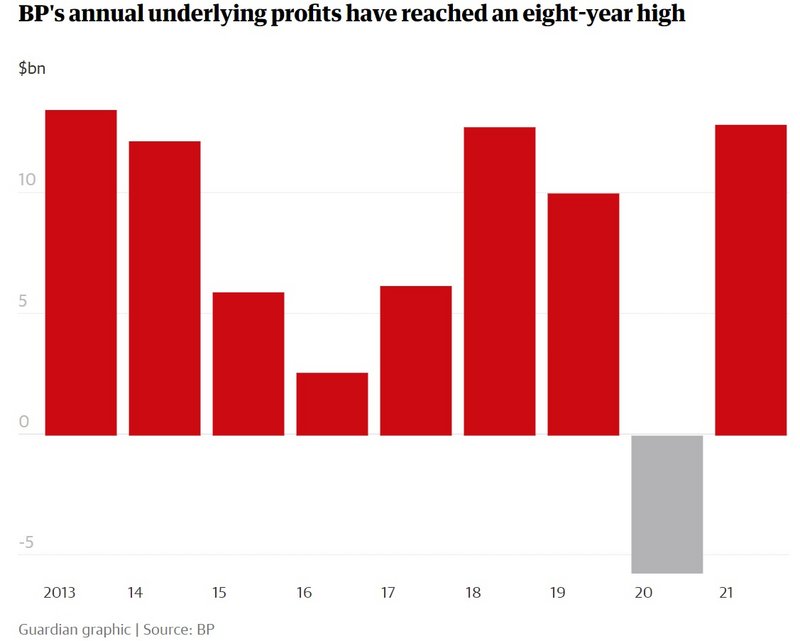

But the biggest exaggeration is the baseline where they are starting from when energy companies (especially FF) were losing massive amounts of money from the Covid energy depression,

BP 24 billion dollar loss.

Shell 27 billion dollar loss.

ExxonMobil 22 billion loss.

So if you compare when there was practically no profit and compare when there is going to be a normal profit, its going to look very exaggerated.