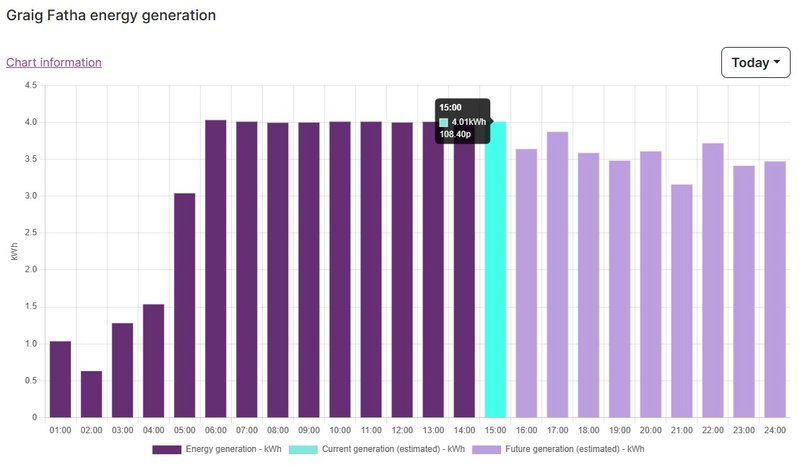

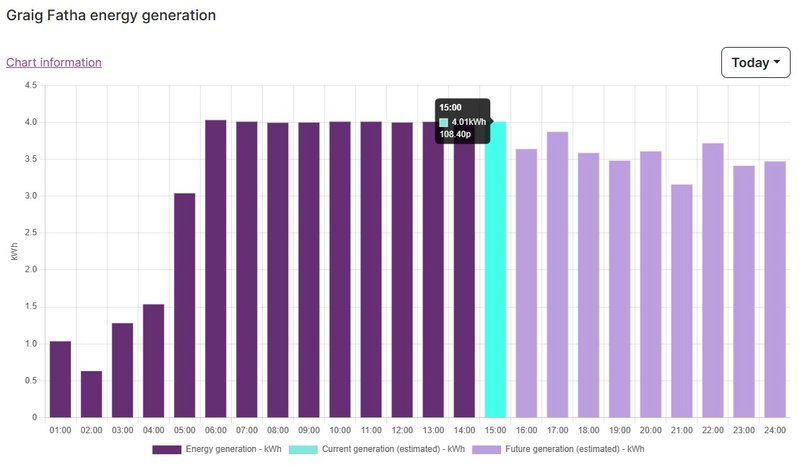

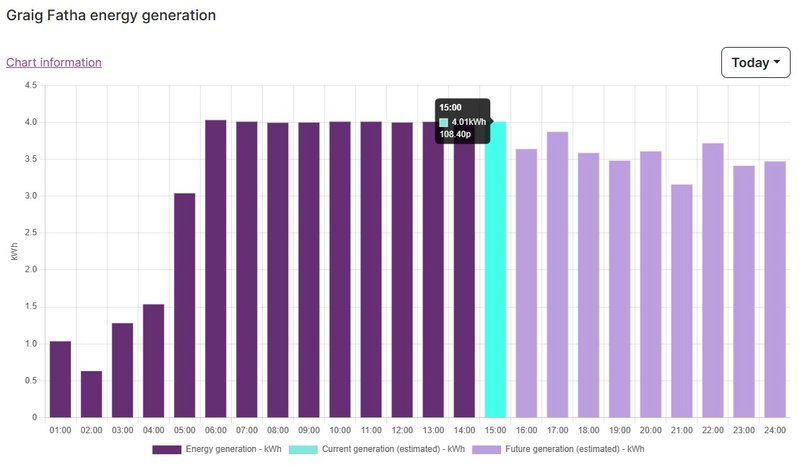

Thats a new sight on my Ripple dashboard, over 4kW output from my share of GF.

The transfer of a little over 1kW to me from my late father's share of GF came through only yesterday. So the "passing on", of a Ripple project via inheritance thing works ok, just death certificate needed, no need to wait for probate and no admin fee. My brother also joins the GF club too.

If the investment is held for over 2 years its inheritance tax free as it qualifies for business tax relief.

https://www.uk.coop/resources/community ... itance-tax

And he held them for over 2 years.

https://camelot-forum.co.uk/phpBB3/view ... p=902#p902