There has been some mixed messaging about this.TCA wrote: ↑Thu Mar 10, 2022 7:23 pmThe 120% of home usage rule is Ripple aligning themselves with the tax-free limit for microgeneration, but they haven't established with HMRC whether it's relevant or not. As there definitely appears to be a taxable benefit to the co-op bill credit, the home usage thing seems a complete red herring.

I spoke to ripple at length a few months after the launch of WT1, they wanted some feedback as the fund raising was not going to well and I volunteered. They told me the biggest obstacle to get started was getting agreement from the Financial Conduct Authority (FCA) who was concerned about tax avoidance as some people were putting very large amounts of money into these sorts of schemes. And that seemed to be the main reason on the 120% limit.

Later ripple publicly spoke several times regarding WT1 and the 120% was mentioned as attempting to align with the tax free limit of microgeneration. It sounded plausible and the legislation was updated to include the same coverage for SEG to align with FIT. But to extend it to this type of investment was a stretch because it specifically said at your own premises (or very close to it). So to extend the location nationally could open up all sorts of unintended issues. Also as many of us have solar panels, you would have to add up the total generation from your solar PV and your ripple wind turbine which might push some of us over the 120% limit, therefore turn our own domestic Solar PV systems into commercial installations and therefore ALL our FITs or SEG could become taxable. So I personally believed this was unlikely to be agreed by HMRC as being unworkable.

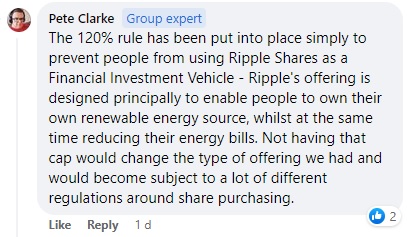

At the WT2 webinar the tax free status attempt was not even mentioned, and replaced with some vague statement about they did not want it to become an investment vehicle. Quite amusing as the CoOp will be a shareholder in a Special Investment Vehicle (SPV).

Today there has been another facebook message which seems to align with what they told me at the start that it was an FCA requirement or some similar regulatory requirement.